2024-02-19 12:16:37.466 GMT

By Taonga Mitimingi and Colleen Goko

(Bloomberg) — Zambia’s currency is in its longest winning streak in nearly a year, supported by an unexpectedly large

interest-rate hike and a decree that local banks hold back more funds in reserve.

The kwacha has climbed almost every day since the Bank of Zambia increased the mininum reserve ratio for lenders on Feb.

5, constricting the flow of funds. Its rally gained further impetus after the jumbo rate increase on Feb. 14.

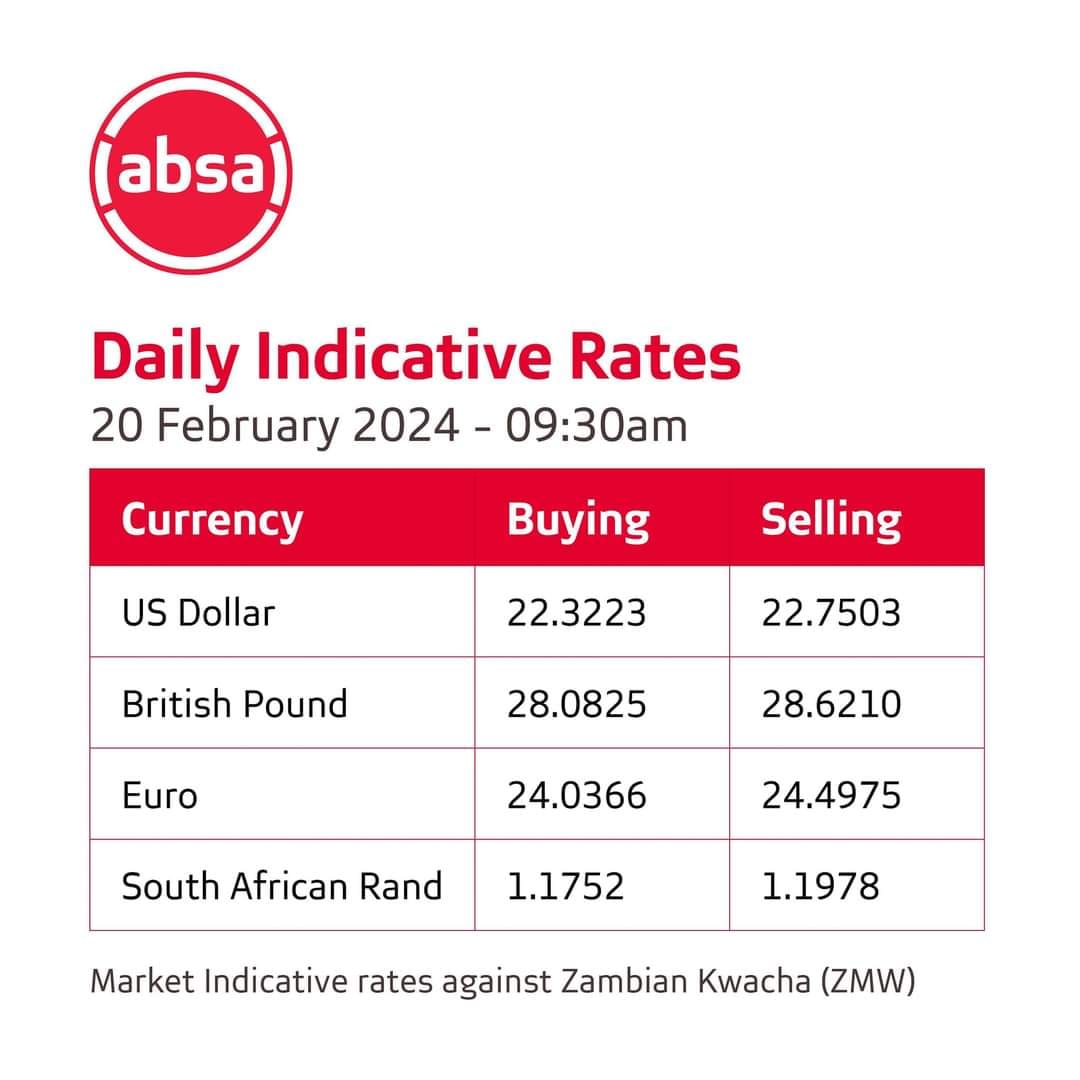

The kwacha has strengthened 10% against the dollar this month, outpaced only by Kenya’s shilling among global currencies tracked by Bloomberg.

Aside from fighting inflation, the curbs on bank lending pushed some local investors with long dollar positions to sell the greenback, according to analysts at First National Bank of Zambia Ltd.

The currency has climbed to 24.73 to the dollar, its strongest level since mid-December.

“It is yet too early to tell the level at which the current gains will bottom out,” the team including Mulenga Kawimbe wrote in a note to clients. “We are of the view that a break of the 22.00 level is possible.”*

The Bank of Zambia raised the reserve ratio to 26% from 17% and followed that up last week by increasing interest rates to the highest level in almost seven years. The bank’s monetary

policy committee raised its key lending rate to 12.5% from 11%, hiking for a fifth straight meeting.

The central bank’s latest moves have helped engineer a turnaround in the kwacha’s fortunes. The currency snapped a 75-

day run of declines following the reserve ratio announcement.

Between Oct. 16 and Feb. 5, the kwacha dropped 21% against the greenback.

The southern African nation imports everything from fuel to fertilizer and some foodstuffs, and weakness in its currency has

driven up inflation, which jumped to 13.2% in January.

The kwacha’s slide was stoked by lower production of copper, the southern African nation’s main foreign-exchange earner, and a

standoff among creditors that has stalled efforts by the continent’s first pandemic-era sovereign defaulter to restructure its debt.

The kwacha rose for a sixth day on Monday, its longest sequence of gains since April.