LUNGU’S CABINET APPROVED THE SALE OF SBP- Dr. NAMA

FORMER President Edgar Lungu’s Cabinet approved the proposal to sale Society Business Park (SBP) to the National Pensions Scheme Authority (NAPSA) at K230 million in 2020, contrary to claims by some politicians that the transaction was orchestrated by the New Dawn administration.

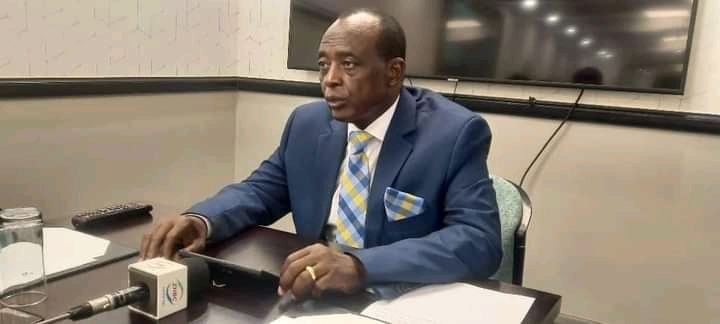

Immediate-past Zambia National Building Society (ZNBS) board chairperson Dr. David Nama also says the institution bought Maanu building situated at Ilunda Park at US$3.2 million and not US$10 million as insinuated by Patriotic Front president Miles Sampa.

Mr Sampa claimed that Government has bought a four -storey building which is former MTN situated next to Citi Bank for around US$10 million.

He alleged that the purchase was made some few months ago through ZNBS whose mandate from the UNIP era is to build or finance affordable houses for ordinary Zambians.

Addressing the media yesterday, Dr Nama said negotiations for the sale of SBP to NAPSA started in June 2019 and were concluded in February 2020.

ZNBS then entered into a contract of sale for the building to NAPSA in December 2020 and the transaction was concluded in April 2021.

“I have been the board chairperson for this organisation for the past six years and I wish to state that negotiations to sale SBP did not start under this regime.

“Plans to sale SBP to NAPSA started in 2019 and when the proposal was brought before the Ministry of Finance, then line Minister Bwalya Ng’andu took this matter to Cabinet, the ECL (Edgar Chagwa Lungu) Cabinet approved the proposal,” he said.

Dr Nama said ZNBS owned Society Business Park and entered into a concession agreement with NAPSA for the refurbishment of the building following an infernal that damaged the infrastructure.

He said among justifications for the sale of the SBP was that according to the concession agreement with NAPSA, ZNBS was only entitled to 3.5 percent of gross rentals per month for a period of 20 years, translating into a yield of 2.9 percent per annum, which was below inflation and, therefore, was not economically profitable for ZNBS.

“The concession agreement further required that NAPSA be paid 50 percent of market value at the end of the concession period of 20 years for NAPSA to exit the agreement. ZNBS would not have the means to make such a payment.

“NAPSA, in its letter to the Society dated November 5, 2014, indicated that the project is not viable for them within the 20-year period as they would be unable to recover the sum invested to re-develop the building. A sale would, therefore, be beneficial to both parties,” Dr Nama said.

He said in a letter dated November 5, 2014, NAPSA requested to buy SBP citing the fact that the concession agreement was not viable as it was not able to recover the investment amount in the 20-year concession period.

“At a meeting held on July 5, 2018, the board of directors of ZNBS resolved to seek approval from the Ministry of Finance for the sale of the Society Business Park, following the approval granted by the Ministry of Finance, ZNBS management commenced exploratory meetings with NAPSA management and a roadmap was proposed, commencing with the preliminary valuation of the Society Business Park,” Dr Nama said.

“At the time of sale of SBP, the society was receiving annual concession fees of K69, 000 per month. Given the need to unlock capital, the board made a decision to sale SBP to support the issuance of mortgages and to purchase a new head office outside the central business district. Even after considering a 100 percent occupancy rate of SBP, the resulting concession fees were too low to make a significant impact on ZNBS’ capital position.”

He said the sale of SBP did not only offer an opportunity to unlock funding into ZNBS’s core business, but a chance to lower the cost of funds for the Society.

“The board approved the proposal for the society to construct a new head office outside the CBD [central business district] in line with the corporate strategic plan. A budget line was approved for the year 2021/2022 to acquire land and design a new head office at a budget of K10 million.

“The Society initially wanted to purchase a plot and build the head office. However, the estimated cost of constructing a 2,500 square metre head office at this land is at US$4.7 million and tendering and construction processes would take approximately two –and- half years,” he said.

Dr Nama said an opportunity then arose to buy Mannu building situated at Ilunda Park.

“The selling price was renegotiated to K89 million before VAT [value added tax], which is the equivalent of US$3.2 million at the current exchange rate, against a reserve price of US$ 8 million and a valuation of US$ 7 million,” he said.

LUNGU’S CABINET APPROVED THE SALE OF SBP- Dr. NAMA